Authors

Cagin Keskin

Download

- Paper

- [Presentation slides](will be added soon)

Abstract

Horizontal expansion through an increasing product portfolio lies at the core of modern endogenous growth literature. Yet evidence remains limited on how diversification across industries influences a firm’s trade-off between generating social surplus and capturing private returns. To investigate this, I categorize intangible assets by their spillovers: transferable intangibles (patents, software) generate social surplus, whereas embedded intangibles (organizational capital, brand value) primarily yield private returns. I document that diversified firms reallocate investment toward embedded intangibles, a strategic shift accompanied by declining markups and productivity, as well as reduced innovation by their rivals. Motivated by this evidence, I extend a canonical endogenous-growth framework to endogenize firms’ allocation between transferable and embedded intangibles while allowing for both horizontal and vertical expansion. A key prediction of the model is that embedded intangibles are the primary driver of a firm’s ability to expand across industries, which also raises entry barriers for competitors and decreases social return rather than promoting long-run growth. Thus, the shift in innovative effort ultimately sacrifices economy-wide growth for firm-level market advantages, and quantitative analysis indicates that size-dependent taxes can substantially improve welfare.

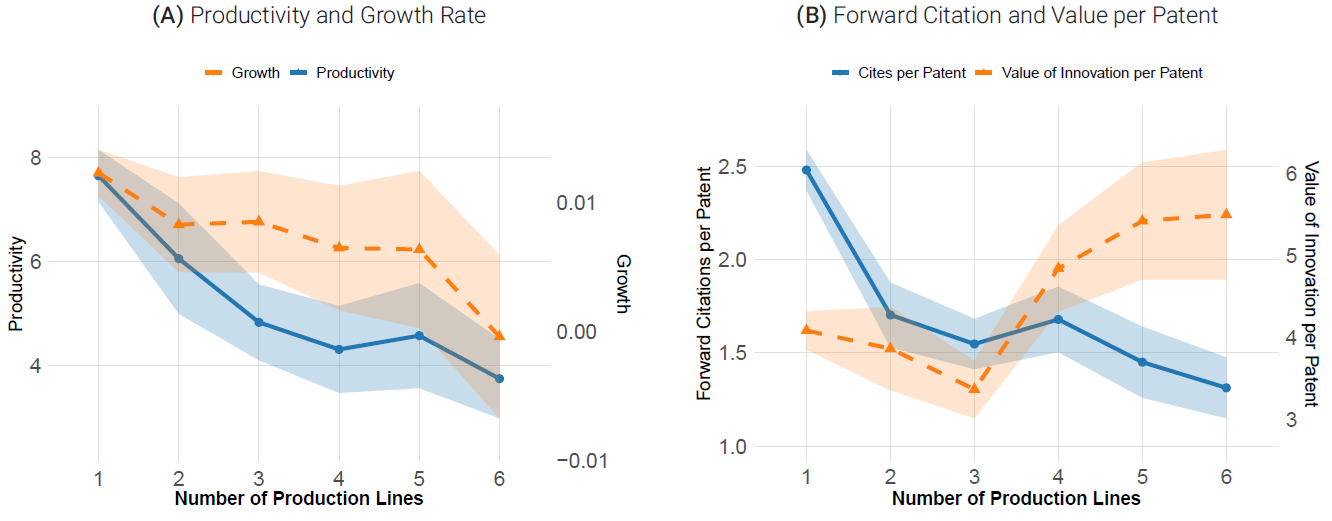

Figure 1: Productivity, Growth & Forward Citation / Value per Patent by Production Line